As the global economy continues to evolve and fluctuate, astute investors are always on the lookout for promising opportunities. In the realm of precious metals, silver stands out as an intriguing option, especially given the current market conditions. With historical silver prices and the gold-to-silver ratio playing a significant role, now is an opportune moment to consider adding silver to your investment portfolio.

1. Historical Silver Prices

Examining the historical price trends of silver reveals a compelling case for investment. Over the past decade, silver prices have shown resilience and demonstrated steady growth. While experiencing occasional volatility, silver has generally outperformed several other asset classes, presenting investors with an attractive option for diversification.

2. Favorable Gold-to-Silver Ratio

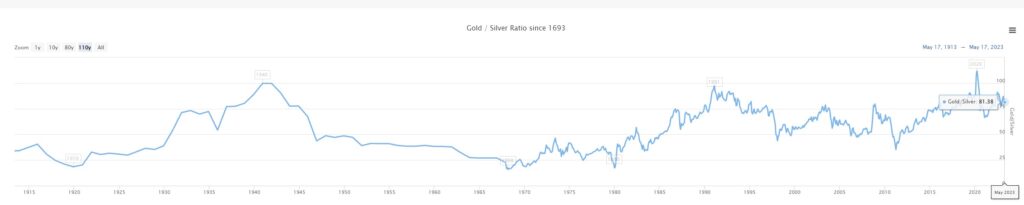

The gold-to-silver ratio, which measures how many ounces of silver are required to purchase one ounce of gold, serves as a valuable indicator for investors. Historically, this ratio has seen significant fluctuations, offering strategic opportunities for those looking to capitalize on silver’s potential. Currently, the gold-to-silver ratio suggests that silver is undervalued relative to gold, making it an enticing investment proposition.

3. Industrial Demand:

Beyond its status as a precious metal, silver boasts significant industrial applications. From electronics and solar panels to medical devices and automotive components, the demand for silver continues to grow. With the rise of renewable energy and technological advancements, the industrial sector’s reliance on silver is set to increase, potentially boosting its value in the long run.

4. Potential for Price Appreciation:

Given the combination of historical price trends, the favorable gold-to-silver ratio, and the growing industrial demand, silver has the potential for substantial price appreciation. Experts suggest that the current market conditions create a unique opportunity for investors to acquire silver at a relatively affordable price, with the potential for significant returns in the future.

5. Diversification and Portfolio Protection:

Investing in silver offers diversification benefits, reducing the overall risk of an investment portfolio. Precious metals, including silver, tend to exhibit low or negative correlation with other asset classes, such as stocks and bonds. This characteristic allows silver to act as a hedge against inflation and economic uncertainties, safeguarding the value of your investments.

As the world continues to navigate economic uncertainties and evolving market dynamics, investing in silver presents an exciting opportunity for discerning investors. Historical silver prices, the gold-to-silver ratio, and the growing industrial demand all contribute to a favorable investment climate for silver. By adding silver to your portfolio, you not only diversify your holdings but also position yourself to potentially benefit from future price appreciation. Don’t miss out on this opportune moment—seize the chance to invest in silver and unlock the potential for long-term financial gains.